Building wealth and securing your financial future is a top priority for many. But what if someone offered a fast track to financial freedom through a company called Five Rings Financial? The promise might sound tempting, but it also raises a big red flag: is Five Rings Financial a legitimate company or something more concerning – a pyramid scheme? Pyramid schemes focus on recruitment over selling products or services, leaving many participants out of pocket. In this blog, we’ll delve into Five Rings Financial’s operations and answer the crucial question: is it a pyramid scheme or a genuine company to work for?

Five Rings Financial: Unveiling the Company

History and Founding: Five Rings Financial opened its doors in 2004, with founder Mike Wilk at the helm. Wilk’s background lies in insurance and financial services, and his vision was to empower Middle Americans with financial literacy.

Mission and Business Model: The company prioritizes educating clients on personal finance fundamentals, believing this knowledge is crucial for achieving financial goals. Their core mission emphasizes overcoming three obstacles: inflation, debt, and taxes. Five Rings Financial operates with a focus on building a network of agents, providing them with extensive training and resources.

Services and Products Offered: While specific details might vary by location, Five Rings Financial generally focuses on insurance and financial products designed to help clients achieve financial security. This could include products like life insurance, annuities, and potentially investment vehicles.

Structure and Compensation Plan

Five Rings Financial operates on a multi-level marketing (MLM) structure, common in the financial services industry. In an MLM, participants earn commissions not only from their own sales but also from the sales made by their recruits. Let’s break down the key elements of their compensation plan:

- Recruitment Incentives: Representatives are encouraged to recruit new members, which raises concerns about whether the focus is on selling financial products or merely on expanding the recruitment base.

- Sales Incentives: Commissions are earned from the sale of financial products like insurance policies and annuities. This element is crucial in distinguishing legitimate MLMs from pyramid schemes.

- Bonuses and Commissions: Additional bonuses and commissions can be earned based on the performance and volume of the sales team.

Pyramid Scheme Characteristics

To assess if Five Rings Financial operates as a pyramid scheme, let’s examine common characteristics of such schemes and compare them with the company’s practices:

- Emphasis on Recruitment Over Product Sales: Pyramid schemes primarily focus on recruiting new members rather than selling actual products. While Five Rings Financial does incentivize recruitment, it also places significant emphasis on selling financial products.

- Unattainable Earnings Promises: Pyramid schemes often promise unrealistic earnings. Five Rings Financial provides an income disclosure statement that outlines realistic earnings potential, which is a positive sign.

- Upfront Investment Requirement: Many pyramid schemes require significant upfront investments. While Five Rings Financial representatives may incur costs for training and licensing, these are standard in the financial services industry and not exorbitant.

Is Five Rings Financial a pyramid scheme?

Five Rings Financial has faced scrutiny and criticism regarding its business model, with some alleging it operates like a pyramid scheme. However, it’s essential to distinguish between a legitimate multi-level marketing (MLM) company and a pyramid scheme. MLMs like Five Rings Financial rely on direct sales of financial products and recruit agents who earn commissions not only from their sales but also from the sales of their recruits. Pyramid schemes, on the other hand, primarily focus on recruiting participants without a genuine product or service, where early investors are paid with the contributions of new investors, unsustainable in the long run. While opinions vary, regulatory bodies like the Federal Trade Commission (FTC) investigate such companies to ensure they comply with laws against deceptive practices. Therefore, whether Five Rings Financial is classified as a pyramid scheme may depend on ongoing legal and regulatory evaluations.

In the U.S., the Federal Trade Commission (FTC) regulates MLMs to prevent pyramid schemes. Companies must demonstrate that they primarily derive income from selling products or services, not from recruitment. To date, there have been no major legal actions against Five Rings Financial suggesting it operates as a pyramid scheme. They appear to comply with industry regulations and standards.

Hence, we can say that Five Rings Financial is not a pyramid scheme. However, its legitimacy remains unclear. To analyze this, we checked reviews on public platforms like Reddit and Glassdoor to see what we found:

Assessment of Five Rings Financial’s Legitimacy Based on Public Reviews

Based on our analysis of reviews on public platforms like Reddit and Glassdoor, the legitimacy of Five Rings Financial remains unclear.

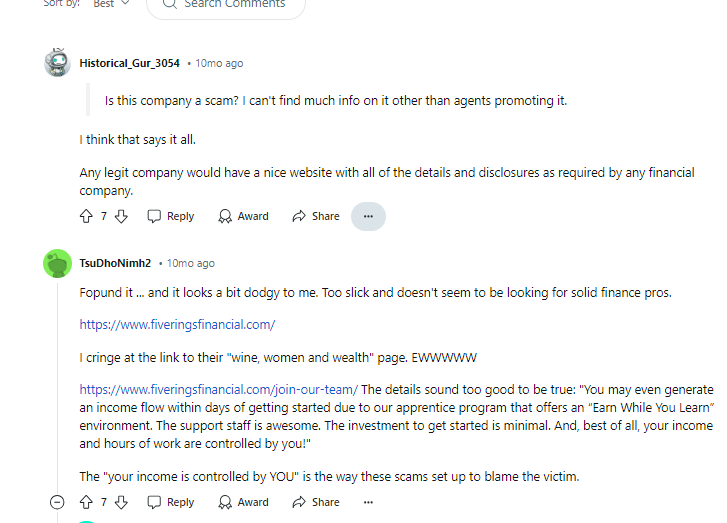

On Reddit, a thread highlighted numerous negative opinions regarding its legitimacy.

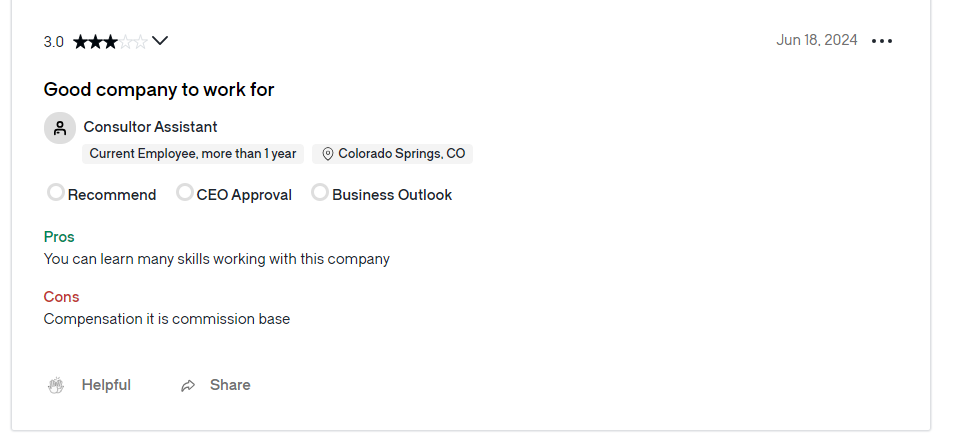

Similarly, on Glassdoor, reviews echoed sentiments such as,

“Multilevel marketing scam company,” and criticism of its commission-only sales structure, indicating it may not operate as a genuine financial services firm.

These insights suggest a need for further scrutiny to determine whether Five Rings Financial adheres to industry standards and regulatory requirements.

Conclusion

In conclusion, while there are differing opinions and criticisms regarding Five Rings Financial, based on public reviews from platforms like Reddit and Glassdoor, it appears that there are significant concerns about its legitimacy. Negative feedback often highlights issues related to its business practices, including comparisons to pyramid schemes and concerns about its operational transparency. However, it’s important to note that definitive evidence labeling it as a pyramid scheme is lacking. To make an informed decision, potential clients or partners should conduct thorough research and consider regulatory evaluations to ensure compliance with industry standards and legal requirements.

Read More: Why McDonald’s Failed in India?

2 thoughts on “Is Five Rings Financial a Pyramid Scheme?”